FINANCIAL LITERACY

A great program for your most valuable resource.

When every minute of the day counts, you need to ensure your employees are focused and engaged in the workplace. Our bank at work program, NBT@Work®, offers your employees the tools and solutions they need to get their financial lives in order.

NBT@Work® provides your employees the tools and solutions to get them on the path to better financial health through:

- Onsite education workshops

- One-on-one financial coaching

- Planning tools and savings strategies

Program Enrollment Options

Business

If you’re a business that would like more information on how NBT@Work® can empower your employees to take control of their financial lives, contact our team or your local branch.

Employee

If you’re an employee who works at a business with a current NBT@Work® partnership you can enroll in the NBT@Work® program now! If you have any questions, please contact our team.

Financial Stress

leads to employee distraction and may even negatively impact their health:

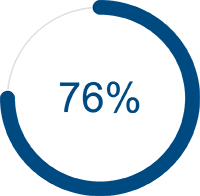

76% of employees are living paycheck to paycheck.

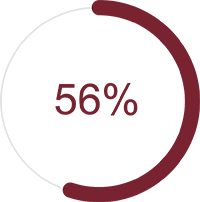

56% of employees are stressed when it comes to their financial situation.

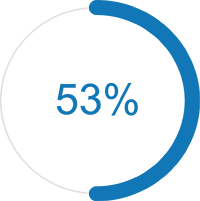

53% of employees report that financial stress interferes with their ability to focus at work.

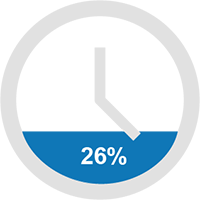

As a result, employees spend working hours focused on finances:

22% spend 3 - 5 Hours focused on finances.

30% spend 1 - 2 Hour focused on finances.

26% spend Less than 1 hour focused on finances.

Solution: NBT@Work®

is designed to help employees improve their financial well-being with:

Financial Education

- Better understand your personal finances

- Improve financial wellness

- Reduce stress & achieve goals

Financial Coaching

- Dedicated banking team for you

- 1:1 coaching for financial advice

- Reducing expenses & decreasing debt

Financial Health

- Establish future savings goals

- Implement savings strategy

- $$ incentives to start savings plan

Convenience

- Financial Wellness Program

- Worksite appointment banking

- Digital banking including online, mobile, ATM, payments and transfers